Do You Have A Retirement Plan We Can Help With?

Educational Guides

An educated investor is a confident investor. RPA offers you several on-line tools that will help you learn about your retirement savings plan, retirement planning, investment choices, understanding Dollar-cost averaging and much more.

- Market Volatility – What is market volatility? Market volatility is defined as large movements in prices (up or down) in a short period. Our guide to Investing in a Volatile Market helps you understand how market fluctuations can impact your retirement account and provides investment strategies to help you achieve your financial goals.

- Dollar-cost Averaging – Learn about one of the basic principles of investing dollar cost averaging and how it can help you reach your retirement goals.

- Test your retirement knowledge – In the world of investments, it is easy to be overwhelmed by “money-talk.” Click here for a quiz to ensure that you understand the economic jargon that investment professionals use. If you need clarification for any of these investment terms, check out our online reference glossary.

- Glossary – wondering what all those investment terms and retirement jargon mean? Visit our Retirement Glossary link on the left includes common terminology you will encounter on your retirement campaign. If you have questions about terms we don’t have listed, send us an email and let us know. We will be happy to update our glossary with your suggestions.

|

Portability Chart as of 2020 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Rollover To Recipient Plan |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO: |

Traditional |

SIMPLE |

403(b) |

Gov’t |

Qualified |

Roth |

Roth |

|

|

|

IRA & SEP |

IRA |

|

457 |

Plan |

401(k), 403(b) and 457(b) Acct |

IRA |

|

|

FROM: |

|

|

|

|

|

|

|

|

|

|

Traditional IRA & SEP |

|

Y |

N |

Ya |

Ya |

Ya |

N |

Nf |

|

|

SIMPLE IRA |

|

Yb |

Yb |

Yb |

Yb |

Yb |

N |

Yb |

|

|

403(b) – Other Than Roth 403(b) |

|

Y |

N |

Yd |

Y |

Yd |

Y |

Ye |

|

|

Governmental 457(b) |

|

Y |

N |

Y |

Y |

Y |

Y |

Ye |

|

|

Qualified Plan – Other Than Roth 401(k) |

|

Y |

N |

Yd |

Yc |

Yd |

Y |

Ye |

|

|

Designated Roth 401(k), 403(b), or 457(b) Account by Direct Rollover |

|

N |

N |

N |

N |

N |

Y |

Y |

|

|

Designated Roth 403(b) Account by Direct Rollover |

|

N |

N |

N |

N |

N |

Y |

Y |

|

|

Roth IRA |

|

N |

N |

N |

N |

N |

N |

Y |

|

|

SUPERSCRIPT LEGEND a Only Pretax amounts from an IRA or SEP may be rolled to these plans. |

|||||||||

|

b Rollovers from SIMPLE IRAs are prohibited until after 2 years of participation. |

|||||||||

|

c Pretax amounts only. |

|||||||||

|

d After-tax amounts may be received only by direct transfer or direct rollover. |

|||||||||

|

e Pension Protection Act permits direct rollover from a non-Roth qualified plan source, non-Roth 403(b) source, and governmental 457(b) to a Roth IRA as of 2008. However, the direct rollover pretax amount is taxable in the year directly rolled to a Roth IRA. As of 2010, Tax Increase Prevention and Reconciliation Act of 2005 (TIPRA) permits conversion to a Roth IRA without AGI limit and without the joint return filing requirement for married individuals. |

|||||||||

|

e Traditional and SEP IRAs may not be rolled into a Roth IRA, but there is a conversion process. As of 2010, TIPRA permits conversion to a Roth IRA without AGI limit and without the joint return filing requirement for married individuals. |

|||||||||

|

Copyright © 2018 Retirement Plan Administrators, Inc. All rights reserved. |

After-Tax Contributions: An amount or percentage of pay an employee elects to contribute from pay, after taxes are calculated and withheld.

Alternate Payee: An alternate payee is a spouse, former spouse, child, or other dependent of a participant, who is recognized by the domestic relations order (DRO) as having a right to receive all or a portion of the benefits payable under the qualified retirement plan with respect to the participant.

Appreciation: The increase in value of an asset.

Asset: A resource having economic value that an individual, corporation, or country owns or controls such as cash, bonds, stocks and/or land with the expectation that it will provide future benefit.

Asset Allocation: The diversification of investments among several asset classes, such as stocks, bonds, and short-term investments (e.g., cash equivalents). Proper asset allocation may limit risk and increase opportunities.

Asset Class: A category of investments, such as stocks, bonds, or cash equivalents

Back-end Load: A sales charge investors pay when they redeem (or sell) mutual fund shares, insurance products, or other investments, generally used to compensate brokers. Also known as a deferred sales charge.

Balanced Fund: A mutual fund that invests in a combination of asset classes (usually stocks and bonds and, in some cases, cash equivalents). Balanced funds seek to provide growth and income.

Benchmark: A standard against which an investment’s performance can be compared, often an index of securities in the same asset class as the investment.

Beneficiary: An individual, institution, trustee or estate which receives, or may become eligible to receive, benefits under a will, insurance policy, retirement plan, annuity or other contract.

Blackout Period: A period of more than three consecutive business days during which participants will not be able to direct or diversify their investments, obtain a loan or take a distribution.

Bond: The most common debt security. A bond is basically an “IOU” certifying that the bondholder has loaned money to a corporation or government and describing the terms of the loan payment period and interest rate. A bond usually matures in 10 to 30 years and pays interest at regular intervals. The principal amount of the bond is repaid at maturity. Municipal bonds are bonds issued by a state, local (city) government, or agency.

Closed-end Fund: A type of investment company that does not continuously offer new shares for sale but instead sells a fixed number of shares at one time in the initial public offering (IPO). After a fund’s IPO, its shares typically trade on a secondary market, such as the New York Stock Exchange. Legally known as a “closed-end company.”

Company Matching Contributions: An amount or percent of pay the company will contribute to the employee’s retirement plan account typically based on the employee’s rate of contribution to the plan. Generally, although the type and amount of company contributions vary, a company may match $0.50 for every $1.00 the employee contributes, up to a maximum percentage of pay, hence the term company match or company matching contribution. The type and amount of a company matching contributions vary and are set by the employer.

Common Stock: Securities that represent an ownership interest and give the investor voting rights in the issuing corporation.

Compound Interest: Interest earned not only on the original investment, but on its accrued earnings as well.

Contingent Deferred Sales Load (Charge): A sales charge that investors pay when they redeem (or sell) mutual fund shares. The amount of the charge depends on the length of time shares were held. After a specified holding period, the charge reaches zero.

Coverdell Education Savings Account: A Coverdell Education Savings Account (or Education IRA) is created exclusively for the purpose of paying qualified education expenses of the designated beneficiary of the trust. Current Year Testing Method: The “Current Year” testing method uses the non-highly compensated employee (NHCE) Average Deferral Percentage (ADP) in the current year to determine the maximum allowable ADP for highly compensated employees (HCE) during the year. This method is sometimes favorable if participation is anticipated to increase and does not (potentially) artificially lower the allowed contributions from the HCE group.

Deferred Sales Charge: A sales charge that investors pay when they redeem (or sell) mutual fund shares, generally used by the fund to compensate brokers. Also known as a back-end load.

Diversification: Directing money into a number of investments that have different levels of risk and return to spread overall risk potential.

Dividend: In a mutual fund, a distribution of investment income earned by the fund.

Dollar-cost Averaging: Investing a fixed amount of money in a specific investment at regular intervals, regardless of market conditions or prices. More shares are purchased when prices are low and fewer shares are purchased when prices are high. In a fluctuating market, the average cost per share is generally lower than the average price per share.

Equity: The ownership interest of shareholders in a corporation.

Exchange-traded Fund (ETF): A type of investment company whose shares trade on stock exchanges at prices determined by the market. Compare to mutual fund.

Expense Ratio: On a mutual fund, the operating expenses, including investment management, administrative and other costs, expressed as a percentage of the assets.

Fixed-income Securities: Investments with specified payment dates and amounts, primarily bonds that pay interest.

Front-End Load: A sales charge applied initially to each deposit. The starting value of the investment is the amount deposited less the sales charge applied.

Global Fund: A fund that invests in stocks throughout the world, including the United States. See International Fund to understand the difference.

Growth Stock: The stock of a firm whose earnings are generally growing faster than the economy or market norm. Investment risk with growth stock tends to be high. Individual Retirement Account (IRA): An individual retirement account, or IRA, is a personal savings plan trusteed by a bank or a qualified nonbank trustee. It allows you to set aside money for retirement, while offering you tax advantages. IRAs cannot be owned jointly. However, any amounts remaining in your IRA upon your death can be paid to your beneficiary or beneficiaries. Types of IRAs include the Traditional IRA, Simple IRA, Education IRA or Coverdell Education Savings Account, and the Roth IRA.

Inflation Rate: A continuing rise in price levels affecting the value of the dollar. The average inflation rate since 1913 has been 3.24% per year.

Inflation Risk: A continuing rise in the price levels affecting the value of the dollar. The average inflation rate since 1913 has been 3.24% per year.

Interest: The price paid by borrowers for the use of money. Companies, governments and municipalities (borrowers) pay interest to investors (lenders) who purchase their bonds.

International Fund: A fund that invests in stocks of companies outside the United States. See Global Fund to understand the difference.

Investment Adviser: Generally, a person or entity that receives compensation for giving individually tailored advice on investing in stocks, bonds, or mutual funds. Some investment advisers also manage portfolios of securities, including mutual funds.

Investment Management and Administrative Charge: Expenses for managing and administering the assets in the separate accounts offered under the group annuity contract.

Large-cap Fund: A fund that invests in the stocks of “large” companies (as measured by market capitalization or the value of a company’s outstanding stock).

Life Expectancy: The estimated age at which an individual is statistically likely to die. This value is taken from a standard mortality table based on gender and year of birth.

Lifecycle Fund: A diversified mutual fund that automatically shifts towards a more conservative mix of investments as it approaches a particular year in the future, known as its “target date.” A lifecycle fund investor picks a fund with the right target date based on his or her particular investment goal.

Liquidity: The ability to turn an asset into cash readily.

Management Fee: A fee paid out of fund assets to the fund’s investment adviser or its affiliates for managing the fund’s portfolio, any other management fees payable to the fund’s investment adviser or its affiliates, and any administrative fees payable to the investment adviser that are not included in the “other expenses” category.

Market Index: A measurement of the performance of a specific “basket” of stocks, bonds, or other type of investment considered to represent a particular market or sector of the stock or bond markets, or the economy.

Market Volatility: The relative rate at which investment market prices move up and down.

Maturity: The date by which the issuer of a bond promises to repay the bond’s face value.

Mid-cap Fund: Invests in the stocks of “mid-size” companies (as measured by market capitalization or the market value of a company’s outstanding stock).

Market Risk: The chance that the value of investments will not grow as expected or may even decline in value.

Money Market Instruments: Forms of debt that mature in less than one year. These investments are easily converted to cash. U.S. Treasury bills make up the bulk of trading in the money markets.

Mutual Fund: A professionally managed pool of stocks, bonds and other securities, which are owned “mutually” by the fund’s investors in proportion to their investment in the fund. The amount of risk varies among the different investments in the fund. In this way, your investment is diversified. There are four basic types of mutual funds.

- Growth mutual fund: A type of mutual fund that seeks long-term capital appreciation.

- Income mutual fund: A type of mutual fund that seeks to provide investors with a stable stream of income from dividends or interest.

- Growth and income fund: A type of mutual fund that seeks a combination of long-term capital appreciation balanced by income from dividends or interest.

- Money market funds: A type of funds that invests in short-term debt instruments and pays market rate interest while striving to keep your investment dollars liquid. A money market fund is NOT guaranteed by the FDIC or any other government agency. Money market funds have generally provided a dependable level of stability and liquidity; nevertheless, a money market fund is still subject to credit risk and liquidity risk. Although this investment seeks to preserve the value of principal, it is possible to lose money by investing in a money market fund. A money market fund may or may not be managed to maintain a stable net asset value of $1.00 per share, and may or may not declare dividends on a daily basis.

Net Asset Value (NAV): The price or market value of an individual share of a security or mutual fund. In the case of a mutual fund, the net asset value is calculated daily and is determined by adding up the value of all the securities and cash in a fund’s portfolio, subtracting liabilities if there are any, and dividing that number by the number of shares the fund has issued. Except for money market funds, which generally strive to maintain a NAV of $1.00 per share, the share value will usually change daily.

Operating Expenses: The costs a fund incurs in connection with running the fund, including management fees, distribution (12b-1) fees, and other expenses. Operating expenses are paid from a fund’s assets before earnings are distributed to shareholders.

Portfolio: A collection of investment holdings either in a fund or in one’s personal account.

Preferred Stock: Class of stock that pays dividends at a specified rate and that has preference over common stock in the payment of dividends and/or upon liquidation of company assets.

Pre-Tax Contributions: An amount or percentage of pay an employee elects to direct from pay, before taxes are calculated and withheld, and contribute to his or her retirement plan account.

Principal: The initial dollar amount invested. The term “principal” is also used to refer to the amount loaned to a company, government or institution when it sells a bond.

Prior Year Testing Method: The “Prior Year” testing method uses the non-highly compensated employee (NHCE) Average Deferral Percentage (ADP) from the prior Plan Year to determine the maximum highly compensated employee (HCE) ADP for the current plan year. This method can assist HCEs in setting their deferral percentage so as to not receive excess refunds at plan year-end. Prospectus: A thorough, written description of a security, including mutual funds, as well as the legal selling document. It describes the fund’s history and investment objective. It also provides information on the background of the fund managers, a financial statement and an explanation of fees required in the sale or management of the fund or security.

Qualified Domestic Relations Order (QDRO): A Qualified Domestic Relations Order (QDRO) is a judgment decree or order made pursuant to a state domestic relations law that creates or recognizes the existence of an alternate payee’s right to, or assigns to an alternate payee the right to, receive all or a portion of the benefits payable with respect to a participant under a qualified retirement plan and that complies with certain special requirements.

Qualified Retirement Plan: Is a retirement plan approved by the IRS that allows for tax-deferred contributions and accumulation of investment income. Individual Retirement Accounts (IRA) and 401(k) plans are examples of qualified retirement plans.

Qualified Roth 401(k) Account: Is a separate account under a 401(k) plan to which designated Roth contributions are made, and for which separate accounting of contributions, gains, and losses is maintained.

Qualified Roth 401(k) Contributions: Voluntary employee contributions that, unlike before-tax elective contributions, are currently included in gross income for current income tax purposes. If a 401(k) plan is going to provide for designated Roth contributions, it must also offer before-tax elective contributions. Qualified Roth 401(k) Distributions: The tax rules for distributions from Roth 401(k) accounts differ significantly from those for traditional 401(k) accounts. If a distribution is a qualified Roth distribution, the entire distribution, including any earnings, is free from federal tax. Qualified Roth 401(k) distributions must satisfy two rules (both, not either/or): the five-year rule and the purpose rule. The five-year rule is satisfied if the distribution from the Roth account is made at the end of the 5-year-taxable period following the participant’s first Roth contribution. For purposes of the five-year rule, the participant’s first Roth contribution is considered contributed on January 1, even if made on December 31, of that same calendar year. If the participant changes employers, a new 5-year period starts with the date of the first Roth 401(k) contribution to the new employer’s plan. However, if the Roth account from the previous employer’s plan is rolled over in a direct rollover to the new employer’s plan, the previous 5-year-taxable period is kept. The purpose rule is satisfied if the distribution from the Roth account is attributable to the participant’s attainment of age 59 ½, disability, or death. Rate of Return: This represents the return on your investment, including interest, dividends and any other income or growth in the value of your investments.

Rebalancing: Bringing a portfolio back to its original (or a desired) asset allocation mix.

Redemption Fee: A shareholder fee that some mutual funds charge when investors redeem (or sell) mutual fund shares. The fee is typically applicable to redemptions made soon after purchase.

Retirement Age: Typically, most pension plans set age 65 as the normal retirement age. However, for Social Security purposes, your normal retirement age, the age at which you can collect unreduced Social Security retirement benefits ranges from 65 to 67, based on your date of birth.

Return: The profit (or loss) earned (incurred) through investing.

Risk: See “Market Risk” and “Inflation Risk”

Risk Tolerance: An investor’s ability or willingness to endure declines in the value of investments in exchange for a greater potential investment return.

Roth 401(k): The Roth 401(k) feature permits eligible plan participants, regardless of their income, to make after tax contributions to a qualified Roth account. In addition, qualified distributions from a Roth 401(k) account are free from federal tax.

Roth IRA: A Roth IRA differs from traditional IRA’s in that contributions are not deductible and can be made only by taxpayers that fall below certain AGI (adjusted gross income) levels. Unlike a traditional IRA, contributions may be made after age 70½. Distributions made after the 5-year-taxable period, beginning with the first year a contribution was made to a Roth IRA set up for your benefit, are not taxable if made either:

- After you are 59 ½

- Because you are disabled

- To a beneficiary or your estate after your death

- To buy, build or rebuild a first home

Securities: A general term for stocks, bonds and money market instruments.

Separate Account: Pooled investment portfolios established by an insurance company. They are not registered with the Securities and Exchange Commission if they are available only to retirement plans that are qualified under Section 401 of the U.S. Internal Revenue Code and certain other governmental plans.

SIMPLE-IRA: “SIMPLE” stands for Savings Incentive Match Plans for Employees. Eligible employees under a SIMPLE-IRA plan may elect to contribute to the plan, similar to a 401(k) plan.

Surrender Charge: A sales charge incurred when an investor withdraws money from an annuity within a certain period after purchase.

S&P 500 Stock: A composite index of 500 large company stocks compiled by Standard & Poor’s Corporation that is used as a broad measure of U.S. stock market performance.

Small-cap Fund: Invests in the stocks of relatively “small” publicly traded companies (as measured by market capitalization or the total market value of a company’s outstanding stock).

Standard of Living: A broad measurement of a person’s way of life, covering factors such as pay, geographic area, home, vehicle ownership and the ability to afford luxuries like vacations. A goal in financial planning is to maintain the same, if not better, standard of living in retirement as during your working career.

Stock: The capital invested in a company or corporation through the buying of shares, each of which entitles the buyer to a part of the ownership. When individuals or institutions buy the stocks, they become owners of a piece of the corporation. This ownership interest is called “equity.”

Target Date Fund: A diversified mutual fund that automatically shifts towards a more conservative mix of investments as it approaches a particular year in the future, known as its “target date.” A target fund investor picks a fund with the right target date based on his or her particular investment goal.

Traditional IRA: A traditional IRA is what most people think of when they think of an IRA. The IRS uses the term “traditional” to distinguish it from any other form of IRA. Any individual with compensation for a calendar year may contribute to a traditional IRA, however you must be under age 70 ½ at the end of the calendar year. Whether a contribution to a traditional IRA is deductible will depend on the individual’s gross income and whether the individual is an active participant in a qualified plan. A single traditional IRA can accept both deductible and non-deductible contributions. Withdrawals taken before age 59 ½ may be subject to a 10% tax penalty.

Transfer: Moving funds from one investment choice to another.

Treasury Bills: Short-term U.S. government debt securities that have maturities of one year or less that is sold at weekly auctions at a discount and is redeemed at face value.

Treasury Bonds: Long-term U.S. government debt securities that have maturities of more than ten years.

Treasury Notes: Intermediate-term U.S. government debt securities that have maturities between one and ten years.

12b-1 Fees: Fees paid by a mutual fund out of fund assets to cover the costs of marketing and selling fund shares.

Unit Value: The value of each unit in an investment account class within a separate account. This value is determined daily by dividing the ending market value of the separate account allocable to that class reduced by the applicable Investment Management Charge and Administrative Charge, by the total number of units in that class prior to any deposits or withdrawals on that day. The total number of units in that class is then increased for deposits and decreased for withdrawals at the unit value for that day.

Value Fund: A mutual fund whose manager buys primarily undervalued stocks for the fund’s portfolio with the expectation that these stocks will increase in value.

Yield: The annual dividend or interest payment an investor expects to receive, divided by the price of the stock or bond.

What is a 401(k) Plan & how does it work? A 401(k) is qualified plan established by employers to which eligible employees may make salary deferral (salary reduction) contributions on a post-tax and/or pre-tax basis. Employers offering a 401(k) plan may make matching or non-elective contributions to the plan on behalf of eligible employees and may also add a profit-sharing feature to the plan. Earnings accrue on a tax-deferred basis.

A 401(k) is a retirement plan, not a savings account. Money placed in a 401(k) is not easy to access in an emergency. Some plans allow loans and hardship withdrawals, but the rules governing them are restrictive.

How will my 401(k) account affect my Social Security Benefits? Your 401(k) account will have no effect on the amount of Social Security benefits you will be able to receive. However, it is important to realize that Social Security is not intended to provide for your entire retirement, but is meant to serve as a supplement to other income sources. For example, if your current income is $30,000 per year, the benefit you receive from Social Security will be approximately 40% of this, or $12,000 per year. This percentage varies according to your income. Hence, if you like to maintain the same standard of living you had while you were working, you do not want to rely on Social Security to be your only source of income after retirement.

What happens to my account if the company I work for goes bankrupt? All the contributions made to a 401(k) account are held in trust by a custodian separate from the company sponsoring the plan, meaning that your employer does not have access to any of the money that is contributed to your 401(k). In other words, regardless of whether your employer goes bankrupt or is bought by another company, the vested amount of money in your account is always yours.

How will I be taxed when I withdraw the money? Under the current Federal tax law, amounts withdrawn from your retirement account will be taxed to you as ordinary income. (If allowed, any after-tax contributions you make to your retirement plan would be returned to you free of tax) if you withdraw $10,000 of deferrals and earnings from your account in any year, you must generally include that amount in your income for tax purposes.

Keep in mind that distributions before age 59 ½ , death, or disability are generally subject to a 10% early withdrawal penalty tax, as well as regular income tax. A number of exceptions apply (death, disability or beneficiary distribution or the estate of the plan participant on or after the participant’s death). However, you may be able to avoid immediate taxation by transferring your eligible distribution to a “rollover” individual retirement account (IRA) or a new employer’s retirement plan. That way, you will not owe any taxes until you make withdrawals from the IRA or retirement plan.

What are catch-up Contributions? These are contributions that people age 50 or older may make an additional contribution above any IRS or Plan limits. The Catch-up Contribution amount for 2021 is $6,500.

What is the Tax Credit for contributions? The Tax Credit, or savers credit, is a temporary, non-refundable tax credit for lower income taxpayers who make salary deferrals to 401(k), 403(b), 457, SIMPLE or SEP plans, or regular or Roth IRA. You should consult your tax advisor for more information on this credit.

Changing Jobs

If I leave my job, do I lose the money I contribute in the plan? No. You own your contributions and any plan earnings on those contributions. If your employment ends for any reason, the money is yours to take with you.

What are my distribution options?

Maintain your tax-deferred benefits by moving your money into an IRA – An excellent way to preserve the tax-deferred benefits of your investment from your previous employer’s retirement plan is to transfer or “rollover” your money into an IRA.

By moving your money into a Rollover IRA, you may avoid an immediate 20% federal tax withholding. Depending on your tax bracket, other federal taxes may apply when you file your income taxes (additional state and local taxes may apply). In addition, you may pay a 10% IRS penalty if you are under the age of 59 ½ (additional state taxes may apply). By moving your money into a Rollover IRA, you may avoid these tax implications. If you decide to take a lump sum distribution from your retirement plan, are under the age of 59 ½, and you fall within the 28% tax bracket, here is what will happen to your savings balance:

| Original account balance | $ 30,000 | ||

| 20% immediate Federal tax withholding | $ -6,000 | ||

| 8% additional Federal tax due at filling | $ -2,400 | ||

| 10% IRS penalty for early withdrawal | $ -3,000 | ||

| What is left… | $ 18,600 | ||

Not including any additional state penalties or state and local taxes you may have to pay, it would cost you $11,400 to take all your cash out of your prior plan! If you leave it in your previous plan or roll over your $30,000 to your IRA or a new Employer plan, you get to avoid paying all those taxes or penalties.

Leave your money in your previous employer’s 401(k) plan – Keeping your money in your previous employer’s 401(k) plan will help you maintain the tax-deferred benefits of your retirement savings, but you may have less control of your investment choices and may not be able to borrow money from your plan. However, by leaving it in your previous employer’s 401(k) plan, your account balance may be afforded certain protections from creditors that do not apply to Rollover IRA’s.

If you choose to leave your account balance in your previous employer’s 401(k) plan, you may roll it over into a Rollover IRA or take a cash lump sum distribution in the future.

Transfer your money into your new employers’ retirement plan – If your new employer offers a retirement savings plan, you may be eligible to roll over your money into the new plan. There are often different rules and requirements with each plan. If you choose this option, your account balance may maintain its tax-deferred status as well as receive certain protections from creditors. Be sure to consult your new employer for specifics about their retirement plan and how to transfer your account balance from your previous employer.

Take cash from your retirement plan – You may take all of your money out of your retirement plan by taking a lump-sum distribution, but you may lose a substantial amount of your savings in the process. Once you take all of your money out of your retirement plan, you lose your tax-deferred investment benefits.

Here is what you can expect if you cash out:

-

-

- 20% will be immediately withheld for federal taxes.

- 10% IRS early withdrawal penalty if you are under the age of 59 ½ (additional state penalties may apply).

- Depending on your tax bracket, you may have to pay additional taxes when you file your federal income taxes. For example, if you are in the 28% tax bracket, you will have to pay an additional 8% when you file your federal income taxes (20% was already taken in advance when you cashed out). Additional state and local taxes may also apply. If your tax rate is lower than 20%, you may receive money back from the federal government when you file your annual taxes.

- You have lost a source of retirement savings. Your money is no longer earning tax-deferred interest and you have sacrificed part of your long-term investment strategy for short-term gain.

-

For more information regarding the tax consequences of a lump-sum distribution, you should consider seeking advice from a professional financial or tax advisor.

Is there a limit on how much can be contributed to a 401(k) plan? Yes. The tax law sets a dollar limit on how much pay you can contribute each year. Many plans also have a percentage limit based on compensation. For example, a plan may limit contributions to 70% of eligible compensation. Please refer to the current annual limits established by the IRS for 401(k) plans by following this link.

Why do you need to save for retirement? A secure retirement future does not just happen. It takes vision, planning, and determination. Part of the planning you need to do involves understanding why you need to save for retirement in the first place. Please contact a Human Resources representative at your company and ask for an enrollment booklet to learn how to enroll in the 401(k) retirement program they have available to you.

I lost or forgot my Password. How can I get another one? Your initial login will be your social security number (SSN) and password is your last four digits of your SSN, unless you have changed them previously. If you still have trouble, for assistance obtaining a new password, please contact your plan administrator at 404-531-8298 or email helpcenter@401krpa.com. Upon successful login, you can choose your own password and user ID, and even set-up a password reminder on-line, so later on if you forget we can e-mail you the password to the e-mail account you have designated.

How do I make an address change? You can make address changes online by logging into the website at www.401krpa.com and after login into your account by visiting the Personal Profile section in the Summary Page. You can also contact the plan administrator at 404-531-8298 or email helpcenter@401krpa.com.

What is vesting? Am I vested? Vesting refers to the ownership of your account balance. You are always 100% vested in your contributions to the plan, any earnings on your contributions, and any money you have rolled over into your account from another plan. On the other hand, contributions made by your employer to your account may be subject to a vesting schedule. Vesting in company contributions is based on years of service with the company, which in most cases starts to accumulate on your hire date (not to be confused with your start date in the retirement plan). To see your company’s vesting schedule, as well as your specific vesting rules, please see your Summary Plan Description, or speak with the Human Resources at your company.

Can I take out a loan from my account balance? If your retirement plan permits, you may borrow the lesser of 50% of the vested balance or $50,000 minus the highest outstanding loan over the previous 12 months. For more information regarding your plan’s loan provisions, contact your plan administrator. Please note that not all retirement plans have a participant loan provision.

What are some of the advantages and disadvantages of borrowing from a retirement plan account? If you borrow from your own account, you become your own creditor. One potential cost is the loss of tax-deferred interest. You lose the benefit of future compounding when the money is not in your account. Your loan repayment (principal and interest) goes directly back into your plan account. Although you earn the loan interest, paying it directly to your account, you could earn a potentially higher return on the money through your plan’s investment choices.

Competitive interest rates are typically 1% over the prime rate. You make your loan payments (principal and interest) with after-tax dollars. When you retire and take distributions out of your plan, the interest you have paid on the loan will be taxed again.

Because it is a loan and not a distribution, you do not incur federal or state taxes upon receiving the loan funds. However, if you default on the repayment you will be taxed on any unpaid loan balance as a distribution. If you stop making loan repayments, the outstanding loan balance is considered a distribution and will be subject to federal and possibly state income tax. In addition, you may also be subject to an IRS 10% early withdrawal penalty if you are under 59½ years old.

Repayments are easy and convenient through payroll deductions. Depending on the amount of your loan repayments, they may affect your ability to continue participating in the plan at the same contribution percentage. You select the term of your loan, usually between one and five years. Loans taken for the purchase of a principal residence may allow longer repayment terms.

How do I repay my loan and can I repay it early? Loan payments are due each pay period via payroll deduction. The payroll frequency may be weekly, bi-weekly, or monthly. An amortization schedule will be sent to you when you take out the loan so that you will be aware of your payment amount and frequency.

You may repay your loan in full at any time. However, you may not make partial re-payments. To repay your loan in full you must send a cashier’s check or money order to the plan administrator at your company, who will send the check and advise RPA, Inc. that your loan is paid in full.

Can I take more than one loan at a time? If your plan permits loans, it may limit the number of loans a participant may have outstanding at any given time. Please check with the plan administrator at your company for more information.

How do I make a hardship withdrawal? If your plan permits hardship withdrawals, contact the plan administrator at your company for a Hardship Request form. Once your plan administrator has submitted the completed form to RPA, it should take 2-3 business days to process. In order to be eligible for a hardship withdrawal, the purpose of your withdrawal must fit one of these distinct categories defined by the IRS:

-

- Costs related to the purchase (not mortgage payments) of a primary residence

- To prevent eviction from or foreclosure on a primary residence

- Post-secondary education expenses for self, spouse or a dependent

- Un-reimbursed medical expenses for you, your spouse, or other dependents

- Funeral or burial expenses

- Repair of damage to principal residence for casualty loss

Aside from these strict IRS guidelines, your plan may also have other qualifying provisions. Please check with the plan administrator at your company to see if you are eligible to take a hardship withdrawal.

What are the taxes and penalties associated with hardship withdrawal? If you take a hardship withdrawal, you must pay federal taxes and applicable state taxes on the amount of the distribution taken. You may also be subject to a 10% early withdrawal federal tax penalty, in addition to a state income tax penalty if you are under age 59 ½. You will also not be permitted to contribute for six months following the distribution and the limit on your deferrals in the tax year after you receive the hardship distribution will be reduced by the deferrals you made in the tax year you received the distribution.

What is the maximum amount that I can contribute to the plan? The IRS defined maximum dollar amount a participant may contribute to a retirement plan. For the year 2021 is $19,500*. You may also be eligible to contribute an additional “catch-up contribution” of $6,500* if you are over age 50 (if allowed by your plan). Your employer may also contribute to your retirement plan account. The total annual contribution, including employer contributions, but excluding “catch-up contributions”, cannot exceed $58,000 or 100% of total compensation, whichever is less.

*COLA increase, if any, in $500 annual increments.

What happens to my retirement account if I die? A distribution is paid to your designated beneficiary (ies). If there are no beneficiaries listed, the distribution will be paid to your spouse, children, or estate, depending on the plan provisions and state law.

If I am a beneficiary and the participant has passed away, what do I need to do? You will need to contact the plan administrator at the participant’s company and request a death distribution from the account. You may have this account balance paid directly to you, subject to federal and state, taxes.

How do I choose the investments in which to invest my money? Many factors need to be considered when you are choosing your investment allocation. Two of the most important factors that need to be taken into account are how long you have until retirement and your personal risk tolerance. If you have many years until retirement (more than ten years is a good benchmark for some, but 20 or more years is even safer), then you can often afford to take more risk in your investments. However, you do not want to be uncomfortable with your choices, so you must find the perfect mix of investments for you personally. Reading a fund’s prospectus or speaking with an investment advisor are just two examples of resources that may help you in this decision. You can also complete the risk assessment questionnaire available on our enrollment booklets. Do not forget you can always change your investment allocation if you find that your first choice is not working for you.

How often should I change my investment choices? There is no uniform answer to this question. It is really a matter of preference. Some people will review their investment choices when they get their statements, while other may only look at them once a year. However you choose to monitor your investment choices, make sure you have a strategy in mind. If a life event causes your strategy or goals to change, then that is probably a good time to make sure your investment choices are in line with your new goals.

What types of risk will my money be exposed to? Your account will be exposed to a variety of types of risk depending upon how you choose to allocate your funds between investments. Investing in stocks, for example, exposes you to the everyday volatility of the market, but long-term they often tend to have the highest potential for gains. If you choose to invest in foreign stock, you run the risk of political turmoil, exchange rates changes, thus affecting your return on investment. If you invest in bonds, there is a chance that interest rates drop, and the possibility that inflation may be higher than the return a bond fund offers, meaning that you are actually losing money. There is no way to escape the risk that your investments will decrease in value, although some types of investments are seen as “less risky” and others as “more risky”. Bonds, for example, are seen as less risky when compared to stocks. However, generally speaking, the higher the risk the higher your potential for greater gains. While it is impossible to completely avoid risk, there are certain things you can do to decrease your chances for losses in your account. Most importantly, avoid putting all of your money into one fund, or one type of fund. Spread your assets among a variety of funds within your plan so that if one fund is not doing well, you have a chance for your other investments to make up for any losses. Bear in mind that everyone has a different tolerance for risk and the closer you are to retirement, the more closely you may want to guard your amount of risk exposure. See also Inflation Risk and Market Risk in our glossary.

How often will I receive my account statements? You will receive an account statement after the end of each plan quarter. For any questions regarding your statements, contact the plan administrator at your company or RPA, Inc.

I am no longer employed with the company and need to access my money. How can I take my money out? If you have more than $5,000 in your account, you may leave your money in the plan. If your balance is $5,000 or less you may be required to take a distribution. Either way when you leave the company you may roll over the money into an IRA. Contact RPA at 404-531-8298 or email helpcenter@401krpa.com.

You may also receive a lump sum distribution, subject to federal and any state income tax. In addition, if you are under age 59 ½ a 10% federal income tax early withdrawal penalty and state income tax penalty may apply.

Contact the plan administrator at your previous employer for more information about your distribution options and to obtain the necessary forms to withdraw your money from the plan.

Where can I obtain my account balance? When you log into the Web site, click on the participant login link to the left side of the page; then enter your unique user ID and password and you are automatically taken to the Account summary page, which contains your account balance and other pertinent information about you. You can also check your balance by checking 401kRPA.com. Alternatively, you can contact us by phone 404-531-8298 or email helpcenter@401krpa.com.

Defined Benefit Plan A defined benefit plan is always a pension plan. This type of retirement plan is structured to provide a participating employee with a specific benefit amount upon attaining the normal retirement age specified in the plan. An employee’s future benefits are determined by means of a formula. The employer is guaranteeing certain benefits. Fluctuations in the stock market have no bearing on the participant’s balance at retirement. Click on Defined Benefit Plans for more information.

Cash Balance Pension Plan A hybrid defined benefit plan that has some of the features of a defined contribution plan. The most distinguishing feature of a cash balance pension plan is its use of a separate account for each participant. The plan sponsor is responsible for investment decisions. Investment risk (market fluctuation) is borne by the plan sponsor not the participant.

Defined Contribution Plans General A defined contribution plan defines the contribution the company will make to the plan. Contributions are usually based on a percentage of eligible employees’ compensation. The minimum and maximum employer contributions vary by type of plan. Separate account balances are maintained for each eligible employee. The employee’s account grows through employer contributions, investment earnings and in some cases forfeitures (amounts from the non-vested accounts of terminated participants that may be reallocated to the remaining participants). Some plans may also permit employees to make contributions on a before-and/or after-tax basis. The participant’s retirement, death or disability benefit is based upon the amount in his account at the time the distribution is payable. The maximum annual addition to an employee’s account (taking into consideration all defined contribution plans sponsored by the employer) is subject to limitations. Compensation that may be considered for plan purposes is also capped. These maximums are adjusted for cost of living increases annually. (See “Annual Limits” for current limits.) Click on Defined Contribution Plans for more information.

Profit-Sharing Plan An employer providing this type of plan will allow its employees to participate in the employer’s profits. Contributions to the plan are made by the employer utilizing a predetermined formula. Click on Profit Sharing Plans for additional information.

401(k) Plan A 401(k) plan, also referred to as a “cash or deferred arrangement” (CODA) or “salary reduction plan”, is an arrangement under which an eligible employee may elect to have a portion of his or her salary withheld from the paycheck and deposited directly into the company’s retirement plan. Generally, deferred amounts are not considered to be employee contributions and are not includable in the employee’s gross income or wages for federal and state withholding purposes. The employer may, but is not required to, make contributions to the plan. (See “Annual Limits” for current limits.) Participants age 50 and older are eligible to make “catch up” contributions to their plan. (See “Catch Up Contributions” for current limits.) Click on 401k Plans for additional information.

Stock Bonus Plans This type of plan provides benefits similar to those of a profit-sharing plan except that the employer’s contributions are not necessarily dependent on profits, and benefits are distributable in the form of the employer’s stock. A stock bonus plan is always a defined contribution plan. Please refer to ESOP’s for detailed information.

Money Purchase Pension Plan A money purchase plan (a defined contribution pension plan) is a retirement plan other than a profit-sharing or a stock bonus plan, that provides for fixed or determinable contributions by the employer and individual accounts for each participant.

Simplified Employee Pension (SEP) (after Technical Corrections) A SEP basically provides employer-sponsored Individual Retirement Accounts (IRAs). The employer makes discretionary contributions (from 0% to 25% of the employee’s compensation) by contributing to IRAs established for plan participants and owned by the participants. For additional information, and examples, relating to SEP plans, please click here.

| Name |

Age

|

Income | Traditional | Integrated | Age Weighted | New Comp | SEP | ||||||||||||||||||||||||

| Officer/Shareholder 1 |

63

|

$275,000.00 | $55,000.00 | $55,000.00 | $55,000.00 | $55,000.00 | $55,000.00 | ||||||||||||||||||||||||

| Officer/Shareholder 2 |

56

|

$36,400.00 | $9,100.00 | $8,707.45 | $11,935.46 | $7,677.88 | $9,100.00 | ||||||||||||||||||||||||

| Group A | $311,400.00 | $64,100.00 | $63,707.45 | $66,935.46 | $62,677.88 | $64,100.00 | |||||||||||||||||||||||||

| Future Shareholder |

51

|

$195,000.00 | $48,750.00 | $50,778.03 | $42,522.99 | $24,645.49 | $48,750.00 | ||||||||||||||||||||||||

| Group B | $195,000.00 | $48,750.00 | $50,778.03 | $42,522.99 | $24,645.49 | $48,750.00 | |||||||||||||||||||||||||

| Manager |

36

|

$80,600.00 | $20,150.00 | $19,280.77 | $5,169.85 | $5,642.00 | $20,150.00 | ||||||||||||||||||||||||

| Group C | $80,600.00 | $20,150.00 | $19,280.77 | $5,169.85 | $5,642.00 | $20,150.00 | |||||||||||||||||||||||||

| Staff 1 |

34

|

$30,160.00 | $7,540.00 | $7,214.74 | $1,643.29 | $1,905.92 | $7,540.00 | ||||||||||||||||||||||||

| Staff 2 |

50

|

$54,857.00 | $13,714.25 | $13,122.65 | $11,025.33 | $3,466.61 | $13,714.25 | ||||||||||||||||||||||||

| Staff 3 |

56

|

$83,249.00 | $20,812.25 | $19,914.45 | $27,297.12 | $5,260.80 | $20,812.25 | ||||||||||||||||||||||||

| Staff 4 |

48

|

$41,317.00 | $10,329.25 | $9,883.67 | $7,053.89 | $2,610.97 | $10,329.25 | ||||||||||||||||||||||||

| Staff 5 |

29

|

$49,598.00 | $12,399.50 | $11,864.61 | $1,797.21 | $3,134.27 | $12,399.50 | ||||||||||||||||||||||||

| Staff 6 |

35

|

$54,288.00 | $13,572.00 | $12,986.53 | $3,209.35 | $3,430.65 | $13,572.00 | ||||||||||||||||||||||||

| Staff 7 |

34

|

$28,795.00 | $7,198.75 | $6,888.21 | $1,568.92 | $1,819.66 | $7,198.75 | ||||||||||||||||||||||||

| Staff 8 |

32

|

$65,000.00 | $16,250.00 | $15,549.01 | $3,008.41 | $4,107.58 | $16,250.00 | ||||||||||||||||||||||||

| Staff 9 |

42

|

$68,118.00 | $17,029.50 | $16,294.88 | $7,128.26 | $4,304.62 | $17,029.50 | ||||||||||||||||||||||||

| Staff 10 |

40

|

$40,178.00 | $10,044.50 | $9,611.20 | $3,571.50 | $2,538.99 | $10,044.50 | ||||||||||||||||||||||||

| Staff 11 |

43

|

$27,560.00 | $6,890.00 | $6,592.78 | $3,129.18 | $1,741.61 | $6,890.00 | ||||||||||||||||||||||||

| Staff 12 |

34

|

$36,558.00 | $9,139.50 | $8,745.24 | $1,991.89 | $2,310.23 | $9,139.50 | ||||||||||||||||||||||||

| Group D | $579,678.00 | $144,919.50 | $138,667.98 | $72,424.36 | $36,631.92 | $144,919.50 | |||||||||||||||||||||||||

| Total | $1,166,678.00 | $277,919.50 | $272,434.23 | $187,052.66 | $129,597.29 | $277,919.50 | |||||||||||||||||||||||||

| Group A % | 26.69% | 23.06% | 23.38% | 35.78% | 48.36% | 23.06% | |||||||||||||||||||||||||

| Group B % | 16.71% | 17.54% | 18.64% | 22.73% | 19.02% | 17.54% | |||||||||||||||||||||||||

| Group C % | 6.91% | 7.25% | 7.08% | 2.76% | 4.35% | 7.25% | |||||||||||||||||||||||||

| Group D % | 49.69% | 52.14% | 50.90% | 38.72% | 28.27% | 52.14% | |||||||||||||||||||||||||

There are many benefits to be derived from maintaining a defined contribution retirement plan including:

- Retirement income for owners and employees

- Tax deductible employer contributions

- Tax deferred contributions to to employees’ accounts

- Tax deferred investment earnings

- Increased employee morale

- Reduced Turnover

- Attracts valuable new employees

What are Defined Contribution Retirement Plans?

A defined contribution plan defines the contribution the company will make to the plan. Contributions are usually based on a percentage of eligible employees’ compensation. The minimum and maximum employer contributions vary by type of plan.

Separate account balances are maintained for each eligible employee. The employee’s account grows through employer contributions, investment earnings and in some cases forfeitures (amounts from the nonvested accounts of terminated participants that may be reallocated to the remaining participants). Some plans may also permit employees to make contributions on a before-and/or after-tax basis.

The participant’s retirement, death or disability benefit is based upon the amount in his account at the time the distribution is payable.

The maximum annual addition to an employee’s account ( taking into consideration all defined contribution plans sponsored by the employer) is subject to limitations. Compensation that may be considered for plan purposes is also capped. These maximums are adjusted for cost of living increases annually. (See “Annual Limits” for current limits.)

- The contributions must be made every year regardless of earnings or profits

Unlike profit sharing plans where a discretionary contribution formula allows for flexible contributions, money purchase pension plan contributions generally are based on a fixed rate percentage of compensation. The contributions are mandatory and failure to make a contribution can result in the imposition of penalties. Example: ABC Company’s plan formula is 4% of compensation. ABC must contribute 4% of all eligible employees’ compensation. ABC cannot elect to make a lower contribution for a particular year nor can they decide to make a higher contribution. Like profit sharing plans, Social Security may be taken into account to provide a proportionately larger share of plan contributions to highly compensated employees.

2024 Cost of Living Adjustment Limits

We are pleased to share the latest updates on the 2024 Cost of Living Adjustment (COLA) Limits, essential information for Retirement Plan Administrators. As industry leaders, staying informed about the current COLA limits is crucial for effectively managing retirement plans and ensuring compliance.

Here at 401krpa.com, we understand the significance of these adjustments in guiding retirement planning decisions. Our commitment to providing accurate, up-to-date information empowers administrators to make informed choices that align with the ever-evolving financial landscape.

Key Highlights for 2024 COLA Limits:

- Maximum Contribution Limits: Stay abreast of the adjusted maximum contribution limits for various retirement accounts to optimize participant benefits.

- Income Thresholds: Understand the income thresholds impacting eligibility for certain tax benefits and contribution limits.

- Social Security Updates: Stay informed about changes in Social Security benefits, a critical factor in retirement planning strategies.

- Catch-up Contributions: Explore opportunities for catch-up contributions for those nearing retirement, allowing for additional savings.

At 401krpa.com, we aim to enhance your expertise as Retirement Plan Administrators. Our user-friendly platform ensures that you access the latest COLA limit updates effortlessly, empowering you to navigate the intricate landscape of retirement planning with confidence.

Bookmark 401krpa.com today and unlock a wealth of resources to streamline your retirement plan administration. As the go-to source for industry insights, we are dedicated to supporting your success in managing retirement plans effectively.

For detailed information on the 2024 COLA Limits and other invaluable resources, explore our website or contact our expert team for personalized assistance.

401krpa.com – Your Partner in Retirement Plan Administration Excellence!

2024 Cost of Living Adjustment Limits

What is a One-Person (Solo) 401(k) Plan?

If you are self-employed, rule changes contained in the 2001 tax bill may make a one-person 401(k) plan a viable alternative, as compared to other retirement plans, for small businesses. The solo 401(k) plan is suitable for any business owner who has no employees other than co-owners or spouses. You may work as an independent contractor with 1099 income, freelancer, sole proprietor, or in a partnership, Limited Liability Company (LLC), or corporation. Small business owners can establish an individual 401k and transfer their IRA, 401k, 403b, or other qualified retirement funds into the new individual plan. The principal reason you might want to consider a one-person 401(k) plan is it may offer higher contribution limits versus other retirement plans available for small businesses.

The limitation for 2021 is:

1) The total contribution limit, including employer profit sharing and/or matching contributions, is the lesser of $58,000 or 100% of income if you are under the age of 50. If you are 50 or older on or before December 31, 2018, the limit is increased by $6,500 which is the catchup contribution. Example: If you earn up to $290,000. you can attain the maximum contribution for the 2018 plan year by limiting the contribution percentage to 20 ($290,000 x 20% = $58,000). A person 50 or older could contribute the additional $6,500 catch-up contribution as a deferral, for a total of $61,000 in 2018. You may reach the full funding limit by funding employer contributions only, or by combining employer profit sharing, matching and employee deferrals. In addition to the higher contribution limits, the one-person 401(k) has other advantages. These include: Low paperwork requirements. The only annual paperwork required is the IRS 5500, which applies when the plan’s assets exceed $250,000.

- The ability to take a loan. SEP plans and Simple IRA’s don’t allow loans, although a profit sharing plan could.

Note: Solo 401k plans are not covered under Title I of ERISA, meaning, they do not enjoy the same protection from creditors as do qualified plans. If you would like to receive more information concerning one-person 401(k) plans, please contact Mike Zahariades in Atlanta at (404) 531-8120.

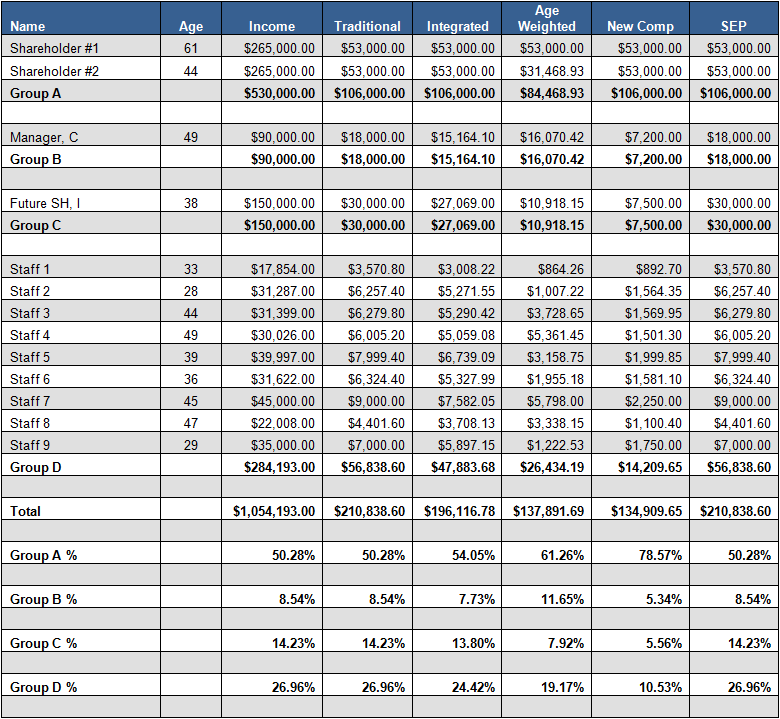

WHAT IS A NEW COMPARABILITY PLAN?

A new Comparability Plan is a type of “Cross-Tested” Plan. The employer contribution is allocated by a formula set out in the plan document. Under a typical new comparability design, plan participants are divided into two or more groups with each group receiving its own level of employer contributions. Examples of groups that may be established are based on job category, age, or age and service. This type of plan design may permit a profit sharing plan to make very substantial contributions for an, on average, older group, yet provide a much lower contribution for the younger and presumably lower paid employees. If the demographics are workable, this will result in a considerably larger contribution to the ownership group than that which could be obtained using permitted disparity or a non-cross tested design. IS THERE ANY DISCRIMINATION TEST TO BE PASSED? Yes, this type of plan is tested for nondiscrimination on a cross-tested basis under Section 401(a)(4) of the Internal Revenue Code. Under the IRS Regulations the differing levels of profit-sharing contributions made to the pre-determined groups may pass nondiscrimination testing if they are nondiscriminatory on a benefits basis. To do this, the contribution allocation is converted into a projected benefit as if the contribution was the amount needed to fund a defined benefit plan’s retirement benefit. If the projected benefit passes this “cross-testing” nondiscrimination test, it is acceptable. CAN NEW COMPARABILITY BE USED WITH A 401(k) PLAN? Yes, new comparability works very well for 401(k) plans in which the employees are not deferring enough to allow the highly compensated employees to defer their desired amount. In these situations, the highly compensated employees are able to achieve the desired level of contribution through a new comparability profit sharing contribution, with no deferrals necessary. Since the highly compensated employees are not making salary deferrals, they are not limited based on the deferral percentages of the nonhighly compensated employees. Highly compensated employees are not dependent on employee deferrals, and a matching contribution is not needed to encourage higher levels of employee deferrals. ARE THERE ANY OTHER LIMITS OR TESTS? Yes, New Comparability plans are subject to all the other limits and discrimination tests applicable to all profit sharing plans and 401(k) plans. In addition, new regulations were recently passed that require additional tests to be met. The plan can test on a New Comparability basis if it provides broadly available allocation rates, age-based allocations, or passes a gateway providing a 5% allocation for all eligible nonhighly compensated employees, or a lesser amount as long as the highest allocation any highly compensated employee receives is no more than three times what the lowest nonhighly compensated employee’s allocation is. For a detailed listing of annual limits on deferrals, catch up contributions and employer contributions, please refer to RPA’s Annual Limitation listing.

Example: Assume the Board of Directors decides to make an annual contribution that would provide the maximum benefit for owners/shareholders under the current tax code provisions. Below is a comparison of the different types of plans available, and the various amounts required to provide the desired benefit.  |

The plan satisfies the nondiscrimination regulations because the equivalent benefit percentages (i.e., the real value of the contributions on a future value basis) for all employees are the same. This plan design may not be acceptable to all employers.

Please contact a RPA representative if you would like to explore these opportunities further, or if you have any questions concerning the application of the new rules to your defined contribution plan.

Get A Quote Today

Let RPA help you retain your business so you can prospect for new business opportunities. With just one call you can:

- Request a proposal

- Discuss plan design

- Meet with our consultants to provide customized service levels

- Get assistance in closing an important sale

- Increase your understanding of the qualified retirement plan market