Do You Have A Retirement Plan We Can Help With?

Overview of Qualified Plans

Defined Benefit Plan

A defined benefit plan is always a pension plan. This type of retirement plan is structured to provide a participating employee with a specific benefit amount upon attaining the normal retirement age specified in the plan. An employee’s future benefits are determined by means of a formula. The employer is guaranteeing certain benefits. Fluctuations in the stock market have no bearing on the participant’s balance at retirement. Click on Defined Benefit Plans for more information.

Cash Balance Pension Plan

A hybrid defined benefit plan that has some of the features of a defined contribution plan. The most distinguishing feature of a cash balance pension plan is its use of a separate account for each participant. The plan sponsor is responsible for investment decisions. Investment risk (market fluctuation) is borne by the plan sponsor not the participant.

Defined Contribution Plans

General

A defined contribution plan defines the contribution the company will make to the plan. Contributions are usually based on a percentage of eligible employees’ compensation. The minimum and maximum employer contributions vary by type of plan.

Separate account balances are maintained for each eligible employee. The employee’s account grows through employer contributions, investment earnings and in some cases forfeitures (amounts from the nonvested accounts of terminated participants that may be reallocated to the remaining participants). Some plans may also permit employees to make contributions on a before-and/or after-tax basis.

The participant’s retirement, death or disability benefit is based upon the amount in his account at the time the distribution is payable.

The maximum annual addition to an employee’s account (taking into consideration all defined contribution plans sponsored by the employer) is subject to limitations. Compensation that may be considered for plan purposes is also capped. These maximums are adjusted for cost of living increases annually. (See “Annual Limits” for current limits.) Click on Defined Contribution Plans for more information.

Profit-Sharing Plan

An employer providing this type of plan will allow its employees to participate in the employer’s profits. Contributions to the plan are made by the employer utilizing a predetermined formula. Click on Profit Sharing Plans for additional information.

401(k) Plan

A 401(k) plan, also referred to as a “cash or deferred arrangement” (CODA) or “salary reduction plan”, is an arrangement under which an eligible employee may elect to have a portion of his or her salary withheld from the paycheck and deposited directly into the company’s retirement plan. Generally, deferred amounts are not considered to be employee contributions and are not includable in the employee’s gross income or wages for federal and state withholding purposes. The employer may, but is not required to, make contributions to the plan. (See “Annual Limits” for current limits.) Participants age 50 and older are eligible to make “catch up” contributions to their plan. (See “Catch Up Contributions” for current limits.) Click on 401k Plans for additional information.

Stock Bonus Plans

This type of plan provides benefits similar to those of a profit-sharing plan except that the employer’s contributions are not necessarily dependent on profits, and benefits are distributable in the form of the employer’s stock. A stock bonus plan is always a defined contribution plan. Please refer to ESOP’s for detailed information.

Money Purchase Pension Plan

A money purchase plan (a defined contribution pension plan) is a retirement plan other than a profit-sharing or a stock bonus plan, that provides for fixed or determinable contributions by the employer and individual accounts for each participant.

Simplified Employee Pension (SEP)

(after Technical Corrections)

A SEP basically provides employer-sponsored Individual Retirement Accounts (IRAs). The employer makes discretionary contributions (from 0% to 25% of the employee’s compensation) by contributing to IRAs established for plan participants and owned by the participants. For additional information, and examples, relating to SEP plans, please click here.

401k Advantages

Amounts contributed to the plan, by the employer or the participant, are not currently taxable to the participant. This tax sheltered status also applies to earnings on plan contributions.

Amounts participants may defer are significantly higher in a 401k plan as compared to a traditional IRA.

Participants may elect to invest part or all of their account balance in various mutual funds chosen by the employer. The mutual fund choices are designed to accommodate a variety of investment styles and objectives.

Your employer may make a matching contribution to your account. The matching contribution is based on amounts the participant defers.

Distributions from the participant’s account can be transferred to, or rolled over to, the participant’s Individual Retirement Account, or to another qualified plan. Please review our Rollover Reference Chart for specific examples.

If your employer’s plan has loan options available, you may borrow from your vested account balance. The Internal Revenue Service has established specific maximum limitations for loans, or the employer may establish their own guidelines. Any employer established guideline must not exceed any Internal Revenue Service prescribed guidelines.

As a plan participant, you may be allowed to withdraw a portion of your account to meet specified financial needs (hardship distribution). Any distribution taken for hardship purposes will be subject to federal and state income tax at the participant’s current tax rate, plus an additional 10% penalty for any distribution taken prior to attaining age 59 1/2.

Note: All of the above listed provisions may not be available in your plan. Your plan’s Summary Plan Description will provide details concerning these provisions.

Safe Harbor 401(k) Plan

Tax Advantages

-

- Employee deferrals are pre-tax and Employer contributions are tax-deductible

- Employees pay no income taxes on contributions or earnings until the participant or their beneficiary receives them

- Tax-deferral maximizes the compounding value and increases the participant’s ultimate retirement income

- Employers pay no income taxes on contributions made to the plan on behalf of the Employees

Safe Harbor 401(k) Features

-

- Employees can elect to defer from 0 up to 100% of their pre-deferred income, up to a maximum of $18,000 ($6,000 catch-up contribution allowed if employee is 50 years old, or older) (refer to Maximum Annual Contributions and Dollar Limits for more detailed information)

- Payroll deductions make deferrals convenient and easy

- Employee pre-tax deferrals reduce their Federal, State* and Local* income taxes but are subject to Social Security (FICA) tax

- No salary deferral discrimination testing, Highly Compensated Employees (HCEs) are not subject to non-HCE deferral rates. HCEs are guaranteed salary deferrals of up to $18,000

- Mandatory Employer contributions of either:

(1) 3% non-elective contribution to all eligible participants or

(2) Basic Matching Contribution equal to 100% match of first 3% of compensation deferred plus 50% match of next 2% of compensation deferred, or

(3) Enhanced Matching Contribution example: 100% match of first 4% of compensation deferred - Mandatory Employer Contributions are 100% vested

- Employee deferrals are always 100% vested

Plan Suitability

Safe Harbor 401(k) Plans are advantageous to the Employer when the Employer:

-

- Wants to eliminate discrimination testing

- Wants to give employees the opportunity to enhance their own retirement benefits

- Wants employees to make part of the their contributions

- Willing to commit to some employer contributions

- Wants to limit Employer contribution obligations

- Wants flexibility in making profit sharing contributions

- Has relatively young key employees

- Wants to attract and keep key employees

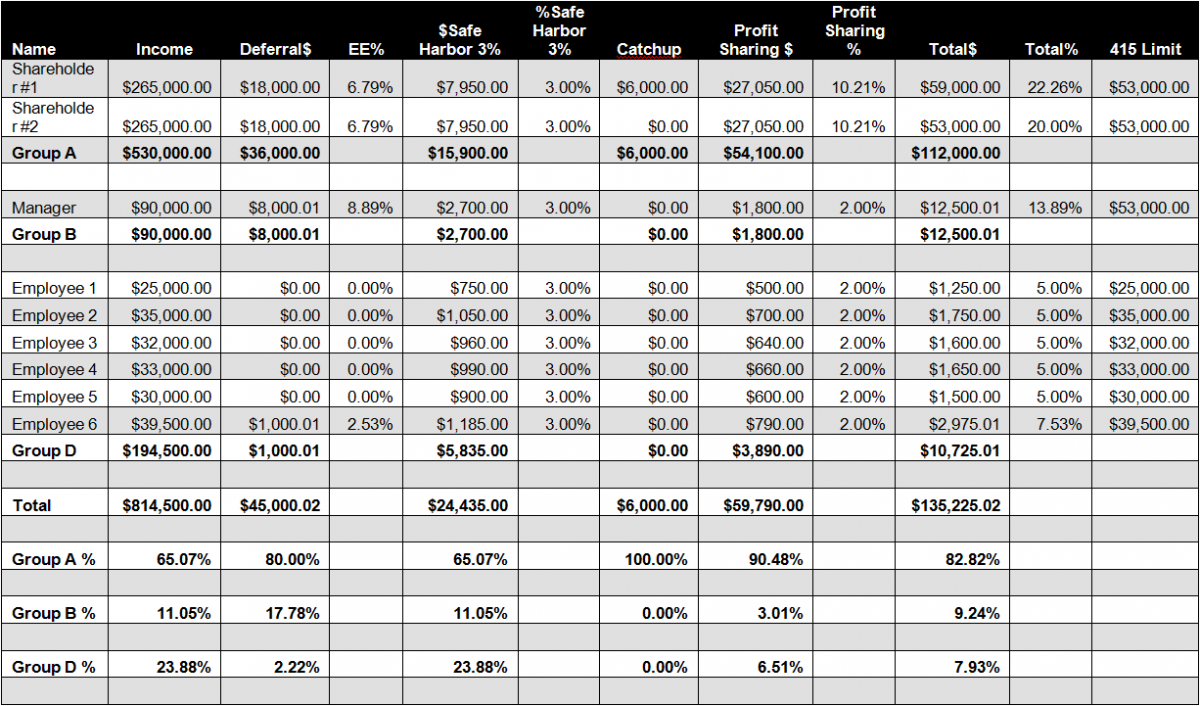

2015 Sample Safe Harbor 401(k) Allocation (assuming 3% non-elective contribution with new comparability profit sharing contribution)

Employer contributions = Safe Harbor 3% of $24,435 and New Comparability Profit Sharing (NCPS) of $59,790

Total Employer contribution of $59,790 of which 90.48% is allocated to Officers/Shareholders.

For example purposes, we have assumed no employees will defer into the plan.

Super Comp & Safe Harbor 401(k) Plans

Plan description

-

- Safe Harbor 401(k) is a 401(k) plan designed with a mandatory employer contribution but does not have discrimination testing.

- A “Super Comp” Plan benefits owners who are closer in age and/or salary to their employees by combining the New Comparability Profit Sharing Plan with the Safe Harbor 401(k).

Key features

- Incorporates the features of a New Comparability Profit Sharing Plan with the 401(k) Safe Harbor provisions.

- Safe Harbor 401(k) permits employers to choose either a 3% profit sharing contribution or a 4% matching contribution on a 5% deferral. Employer contribution must be made each year to maintain Safe Harbor provisions.

- Employees may defer without 401(k)-type discrimination testing.

- All contributions must be 100% immediately vested.

- Participant loans are available.

- Effective in 2002, Safe Harbor plans with matching contributions are not considered top heavy.

- Withdrawals are governed by the plan document and may be restricted.

Who can establish

Businesses, partnerships, S-corporations, C-corporations and nonprofit groups. (Governmental entities excluded) Employers must provide a 30-day notice before establishing plan.

Annual contributions

- Employees can defer up to $19,500 ($26,000 if age 50 or older) (refer to chart for progressive catch up contributions).

- Deferrals and employer contributions cannot exceed the lesser of 100% of each employee’s compensation or $57,000 per employee. Catch-up deferrals are not included in this limit.

- Total deductible employer contributions to the plan cannot exceed 25% of total eligible compensation. Employer contributions do not include employee deferrals.

- Maximum eligible compensation: $285,000.

RPA Annual fees

Due to the complexity involving the contribution calculation, third-party administrative services are required. Contact Retirement Plan Administrators, Inc. to obtain a quote.

Amounts withdrawn from retirement plans are generally includable as taxable income in the year received and may be subject to tax penalties if withdrawn prior to age 59½.

S-corporations and C-corporations are two different types of legal structures, each of which is subject to different tax rules.

Subject to cost of living adjustments.

This information is not intended to be tax advice. Please consult your tax advisor for complete information and its application to your particular situation. Unless specifically stated otherwise, any tax information presented is based upon federal income tax law. State and local income tax laws may differ from federal income tax laws. Some states may not have conformed state income tax laws to the federal changes enacted by the Economic Growth and Tax Relief Reconciliation Act of 2001.

Defined Contribution Plans

There are many benefits to be derived from maintaining a defined contribution retirement plan including:

- Retirement income for owners and employees

- Tax deductible employer contributions

- Tax deferred contributions to to employees’ accounts

- Tax deferred investment earnings

- Increased employee morale

- Reduced Turnover

- Attracts valuable new employees

What are Defined Contribution Retirement Plans?

A defined contribution plan defines the contribution the company will make to the plan. Contributions are usually based on a percentage of eligible employees’ compensation. The minimum and maximum employer contributions vary by type of plan.

Separate account balances are maintained for each eligible employee. The employee’s account grows through employer contributions, investment earnings and in some cases forfeitures (amounts from the nonvested accounts of terminated participants that may be reallocated to the remaining participants). Some plans may also permit employees to make contributions on a before-and/or after-tax basis.

The participant’s retirement, death or disability benefit is based upon the amount in his account at the time the distribution is payable.

The maximum annual addition to an employee’s account ( taking into consideration all defined contribution plans sponsored by the employer) is subject to limitations. Compensation that may be considered for plan purposes is also capped. These maximums are adjusted for cost of living increases annually. (See “Annual Limits” for current limits.)

Money Purchase Pension Plans

Money Purchase Pension Plans are similar to profit sharing plans with one major exception:

- The contributions must be made every year regardless of earnings or profits

Unlike profit sharing plans where a discretionary contribution formula allows for flexible contributions, money purchase pension plan contributions generally are based on a fixed rate percentage of compensation. The contributions are mandatory and failure to make a contribution can result in the imposition of penalties.

Example: ABC Company’s plan formula is 4% of compensation. ABC must contribute 4% of all eligible employees’ compensation. ABC cannot elect to make a lower contribution for a particular year nor can they decide to make a higher contribution.

Like profit sharing plans, Social Security may be taken into account to provide a proportionately larger share of plan contributions to highly compensated employees.

A combination money purchase pension plan and profit sharing plan can limit mandatory contributions while (in years prior to 2002) retaining the ability to make larger contributions in good years. (See note below)

Note: Effective with plan years that begin in 2002, the contribution and deduction limits to profit sharing plans will increase. The maximum contribution the employer will be able to make, and deduct, will be the lesser of 25% of covered compensation or $46,000 (deductible 2008 contribution). In prior years, employers had to have both a money purchase pension plan and profit sharing plan to achieve this contribution level. Employers who currently maintain money purchase pension plans should consider freezing the current money purchase pension plan, then transferring those plan assets into their profit sharing plan. This plan combination would still allow for maximum contributions, and would reduce annual plan administrative expenses. An added bonus to combining these plans is that the surviving plan is the only one that has to be restated for the “GUST” requirements. If you would like more information concerning these provisions, please contact Retirement Plan Administrators, Inc.

Annual Limit on Contributions and Compensation

| Type of Limitation | 2020 | 2019 |

| Elective Deferrals (401(k), 403(b), 457(b)(2) and 457(c)(1)) | $19,500 | $19,000 |

| Section 414(v) Catch-Up Deferrals to 401(k), 403(b), 457(b), or SARSEP Plans (457(b)(3) and 402(g) provide separate catch-up rules to be considered as appropriate) | $6,500 | $6,000 |

| SIMPLE 401(k) or regular SIMPLE plans, Catch-Up Deferrals | $3,000 | $3,000 |

| 415 limit for Defined Benefit Plans | $230,000 | $225,000 |

| 415 limit for Defined Contribution Plans | $57,000 | $56,000 |

| Annual Compensation Limit | $285,000 | $280,000 |

| Highly Compensated Employee 414(q)(1)(B) | $130,000 | $125,000 |

| Key employee in top heavy plan (officer) | $185,000 | $180,000 |

| SIMPLE Salary Deferral | $13,500 | $13,000 |

| Taxable Wage Base | $137,700 | $132,000 |

What is a 401k Plan?

A 401k plan is a qualified profit sharing or stock bonus plan that contains a cash-or-deferred arrangement(CODA). Under a CODA, an eligible employee may make a cash-or-deferred election to have the employer make a contribution to the plan on the employee’s behalf or pay an equivalent amount to the employee in cash. The amount contributed to the plan under the CODA on behalf of the employee is called an elective contribution. Subject to certain limitations (see annual limits), elective contributions are excluded from the employee’s gross income for the year in which they are made and are not subject to taxation until distributed. For purposes of many of the rules applicable to 401(k) plans, elective contributions are considered employer contributions.

A 401(k) plan may be a stand-alone plan (permitting elective contributions only) or may also permit other types of employer contributions and/or employee voluntary contributions. However, a 401(k) plan is the only method available under which employees may defer compensation on an elective, pretax basis to a qualified retirement plan.

Employee Stock Ownership Plans (ESOP’s)

ESOPs in general

Employee stock ownership plans (ESOPs) serve several purposes but, above all, they are retirement plans for employees. As such, they are governed by the Internal Revenue Code (“Code”) and the Employee Retirement Income Security Act (“ERISA”). ESOPs are different from other plans, however, since they: (1) are designed to hold primarily “qualifying employer securities”; (2) may borrow money from a related party, such as the sponsoring company; and (3) provide the additional incentive to employees that derives from sharing in the ownership of the company.

Uses for ESOPs

1. To buy the shares of a departing owner: Owners of privately held companies can use an ESOP to create a ready market for their shares. Under this approach, the company can make tax-deductible cash contributions to the ESOP to buy out an owner’s shares, or it can have the ESOP borrow money to buy the shares (see below). Once the ESOP owns 30% of all the shares in the company, the seller can reinvest the proceeds of the sale in other securities and defer any tax on the gain.

2. To borrow money at a lower after-tax cost: ESOPs are unique among benefit plans in their ability to borrow money. The ESOP borrows cash, which it uses to buy company shares or shares of existing owners. The company then makes tax-deductible contributions to the ESOP to repay the loan, meaning both principal and interest are deductible.

3. To create an additional employee benefit: A company can simply issue new or treasury shares to an ESOP, deducting their value (for up to 25% of covered pay for plan years after December 31, 2001; 15% for prior plan years) from taxable income. Alternatively, a company can contribute cash, buying shares from existing public or private owners. In public companies, which account for about 10% of the plans and about 40% of the plan participants, ESOPs are often used in conjunction with employee savings plans. Rather than matching employee savings with cash, the company will match them with stock from an ESOP, often at a higher matching level.

Caveats

As attractive as these tax benefits are, there are limits and drawbacks. The law does not allow ESOPs to be used in partnerships and most professional corporations. ESOPs can be used in S corporations, but do not qualify for the rollover treatment discussed above, and have lower contribution limits. Private companies must repurchase shares of departing employees, and this can become a major expense. The cost of setting up an ESOP is also substantial — $15,000 to $20,000 for the simplest of plans in small companies and on up from there. Any time new shares are issued, the stock of existing owners is diluted. That dilution must be weighed against the tax and motivation benefits an ESOP can provide. Finally, ESOPs will improve corporate performance only if combined with opportunities for employees to participate in decisions affecting their work.

One-Person 401(k) Plans

If you are self-employed, rule changes contained in the 2001 tax bill may make a one-person 401(k) plan a viable alternative, as compared to other retirement plans, for small businesses. The solo 401(k) plan is suitable for any business owner who has no employees other than co-owners or spouses. You may work as an independent contractor with 1099 income, freelancer, sole proprietor, or in a partnership, Limited Liability Company (LLC), or corporation.

Small business owners can establish an individual 401k and transfer their IRA, 401k, 403b, or other qualified retirement funds into the new individual plan.

The principal reason you might want to consider a one-person 401(k) plan is it may offer higher contribution limits versus other retirement plans available for small businesses. The limitation for 2020 is:

1) The total contribution limit, including employer profit sharing and/or matching contributions, is the lesser of $57,000 or 100% of income if you are under the age of 50. If you are 50 or older on or before December 31, 2020, the limit is increased by $6,500 which is the catchup contribution.

Example: If you earn up to $285,000. you can attain the maximum contribution for the 2020 plan year by limiting the contribution percentage to 20 ($285,000 x 20% = $57,000). A person 50 or older could contribute the additional $6,500 catch-up contribution as a deferral, for a total of $63,500 in 2020. You may reach the full funding limit by funding employer contributions only, or by combining employer profit sharing, matching and employee deferrals.

In addition to the higher contribution limits, the one-person 401(k) has other advantages. These include:

- Low paperwork requirements. The only annual paperwork required is the IRS 5500, which applies when the plan’s assets exceed $250,000.

- The ability to take a loan. SEP plans and Simple IRA’s don’t allow loans, although a profit sharing plan could.

Note: Solo 401k plans are not covered under Title I of ERISA, meaning, they do not enjoy the same protection from creditors as do qualified plans.

If you would like to receive more information concerning one-person 401(k) plans, please contact RPA at 706-724-4557.

Simplified Employee Pension (SEPs)

A SEP basically provides employer-sponsored Individual Retirement Accounts (IRAs). The employer makes discretionary contributions (from 0% to 25% of the employee’s compensation) by contributing to IRAs established for plan participants and owned by the participants.

Since compensation for 2015 SEP contributions is the participant’s first $265,000, the maximum $53,000 under §415(c) can be reached (25% X $265,000 = $66,250, capped at $53,000).

This change also makes regular SEPs comparable to qualified profit sharing plans. Until the technical corrections, SEPs were not as attractive as profit sharing plans. Employers will now be able to achieve the same contribution and deduction limits with a regular SEP as they would with a profit sharing plan. SEPs generally have less administrative requirements than qualified plans.

Unfortunately, this simplicity does not come without some disadvantages:

- There are stricter coverage and vesting requirements for SEPs than for other defined contribution plans

- More employees, such as certain part-time employees, may have to be included in the plan

- Favorable lump sum tax treatment is not available

- All contributions to a SEP must be 100% vested immediately and participants are entitled to withdraw amounts at any time.

Catch Up Contributions

Congress added the new catch-up contribution limits to retirement plans out of concern that aging employees had not been saving enough for retirement. These new limits enable savers age 50 and over (as of the last day of the plan year) to increase contributions as retirement draws near. Age-50 catch-up contributions are possible in 401(k), 403(b) and 457 plans, and IRAs, with the rules differing among plans. The provision focus on the 401(k) rules.

First, prior to deciding to make catch up contributions, understand that you can only make an age-50 catch-up contribution if your plan permits them. Your plan’s Summary Plan Description will tell you if your company has elected to accept catch up contributions.

How They Work

The limit works as follows, assuming your plan permits these contributions and you are age 50 or older in 2010: You may make an additional $5,500 pretax contribution to your 401(k) plan, on top of your regular pretax contribution limit.

| Federal 401(k), 403(b) and 457 Plan Contribution Limits (Your Plan’s Limits May Differ; Check with Your Employer) |

||

|---|---|---|

|

Year |

Regular pretax dollar limit | Catch-up Contribution |

| 2011 | $16,500 | $5,500 |

| 2012 | $17,000 | $5,500 |

| 2013 | $17,500 | $5,500 |

| 2014 | $17,500 | $5,500 |

| 2015 | $18,000 | $6,000 |

(If you have an IRA, keep in mind that the permitted IRA catch-up contributions are lower:

$500 a year through 2006, when they rise to $1,000.)

The best feature about the catch-up limit is that it is not subject to any other federal or plan contribution limits. Catch-ups contributions are made in addition to your current deferral limits. After you contribute the full $18,000 allowed in 2015, you may make an additional $6,000 contribution, for a total of $24,000.

If your plan has restrictions that prevent you from contributing the full $18,000, such as capping contributions at 15% of pay, you can still contribute the $6,000 on top of your other limit. This provision is applicable even if your contributions are capped because you are considered a highly compensated employee (HCE). As an added bonus, the IRS is willing to let employers classify excess 401(k) contributions (up to $6,000) as catch-up contributions. So, if you are an HCE who is 50 or older, and your plan allows catch-up contributions, you should be able to contribute $6,000 over your HCE limit in 2015 without being required to take a refund.

All 401(k) contributions must be made through payroll deduction, including your catch up contributions. If you want to make a $6,000 contribution from a single paycheck, such as a bonus check, make sure you can afford this reduction in your salary for the applicable pay period.

Availability Issues

You cannot take advantage of the catch-up contribution unless your employer amends its plan document to allow them. While many employers did this at beginning of the year, others may not plan to offer catch-up contributions immediately. Participants wanting to make catch-up contributions should make their employer aware of this desire. Knowing that employees are interested might be the incentive the employer needs to get the plan updated.

If you are unsure when your plan may offer catch-up contributions, check with your benefits department.

Maximize Your Catch Up Contributions

Understanding how to maximize catch-up contributions is fairly straightforward. A lot depends on whether your employer makes a matching contribution. If it matches your regular contributions, it is not required to match your catch-up contribution, but it is allowed to. Your Summary Plan Description would provided details concerning matching elections.

If your employer doesn’t provide any matching contribution at all, or if your employer matches both the regular and catch-up contributions, make your full contribution, then you make your catch up contributions.

Defined Benefit Plans

A defined-benefit plan is one set up to provide a predetermined retirement benefit to employees or their beneficiaries, either in the form of a certain dollar amount or a specific percentage of compensation.

Employer contributions to a defined-benefit plan are complex to determine and require the services of an actuary. The assets of the plan are held in a pooled account, rather than individual accounts for each employee, and as a result, the employees have do not participate in investment decisions. Once the plan is established, the employer must continue to fund the plan, even if there are no company profits in a given year. The employer makes a promise to pay a certain sum in retirement benefits in the future, and must assume the risk of fluctuations in the value of the investment pool.

There are three basic types of defined-benefit plans:

-

- Flat benefit plan —all participants receive a flat dollar amount as long as a predetermined minimum years requirement has been met.

A plan calls for payment of 20 percent of average compensation for the last five years to each retiree with at least 10 years of service. If average compensation is $45,000 the monthly benefit would be $750.

-

- Unit benefit plan — provides a benefit that is either a percentage of compensation or a fixed dollar amount multiplied by the number of qualifying years of service.

A benefit of 2 percent of the average compensation of the five highest consecutive years for each year of service. If the average compensation is $50,000 the monthly benefit would be $83 for each year of service.

-

- Variable benefit plan — benefits are based on allocating units, rather than dollars, to the contributions to the plan. At retirement, the value of the units allocated to the retiring employee would be the proportionate value of all units in the fund.

The maximum annual contribution you can make to a defined-benefit plan is one that would be projected to yield a benefit equal to the lesser of $210,000 for 2015, or 100 percent of the participant’s average compensation for the three highest consecutive years. Very few defined-benefit plans provide for the benefits to be adjusted each year to reflect the effects of inflation (called the Cost of Living Adjustment, or COLA), so over the years of your retirement, the value or purchasing power of your benefits may shrink considerably.

The Pension Benefit Guarantee Corporation (PBGC) — If a defined benefit plan is implemented, the employer is legally required to make sure there is enough money in the plan to pay the guaranteed benefits. If the company fails to meet its obligation, the federal government steps in. Defined-benefit plans are the only type of pension insured by the PBGC. The insurance works similarly to the federal deposit insurance that backs up your bank accounts. If your plan is covered and the sponsoring company goes under, PBGC will take over benefit payments up to a maximum amount. The insurance protection helps make your pension more secure, but it is not a guarantee that you will receive the full amount originally promised under the plan.

Cafeteria Plans

Cafeteria plans increase employee take home pay and create no additional costs to the employer. As a tax saving device, both employers and employees may enjoy significant tax savings. Cafeteria plans, also known as flexible benefit or Section 125 plans, give employees the opportunity to choose from a menu of benefits in order to customize their benefit package to meet their particular needs. Cafeteria plans are specially authorized by Section 125 of the Internal Revenue Code.

A typical cafeteria plan allows employees to “redirect” part of their salary to purchase benefits from a “menu” of benefits. These amounts are withheld before an employee’s wages become subject to Federal or State income tax or Social Security taxes (FICA). An employer may also make contributions to the plan on behalf of its employees. These employer contributions are not taxable to the employee if the employer money is used for “qualified” benefits.

Employee participation in a cafeteria plan also reduces the employment taxes paid by an employer. Employee redirections are not subject to FICA or FUTA employment taxes.

Allowable benefits include flexible spending accounts such as dependent care assistance (day care), health care reimbursement (out-of-pocket medical expenses not covered by a group medical plan), and insurance premium reimbursement for employer approved group plans (life, medical, and disability insurance). Non-spending benefits include premium conversion that allows employees to pay premiums for employer sponsored group plans using pre-tax earnings.

Cafeteria plans provide employees valuable benefits, while increasing disposable income, reducing taxes, and reducing your employment taxes.

Get A Quote Today

Let RPA help you retain your business so you can prospect for new business opportunities.

With just one call you can:

- Request a proposal

- Discuss plan design

- Meet with our consultants to provide customized service levels

- Get assistance in closing an important sale

- Increase your understanding of the qualified retirement plan market